Level Up Your Lifestyle

At LevelUp Credit, we believe better credit is more than just a number — it’s a lifestyle upgrade. It’s the difference between feeling limited and feeling limitless. It’s the freedom to dream bigger, move differently, and finally do the things you’ve been putting off because of your credit.

Leveling up your credit can help you unlock:

A beautiful home you’re proud to walk into

A reliable or luxury car with better rates

Financial breathing room and peace of mind

Stability and opportunities for your family

The ability to travel, invest, and build wealth

The confidence to take control of your future

This journey isn’t about perfection — it’s about elevation. Step by step, we help you rebuild, restore, and rise into the lifestyle that reflects your worth.

You deserve a fresh start, a better score, and a better life. And we’re here to help you achieve all of it.

We Rebuild Credit

Fix past issues

Remove negatives

Increase your score

Restore confidence

Build your financial foundation

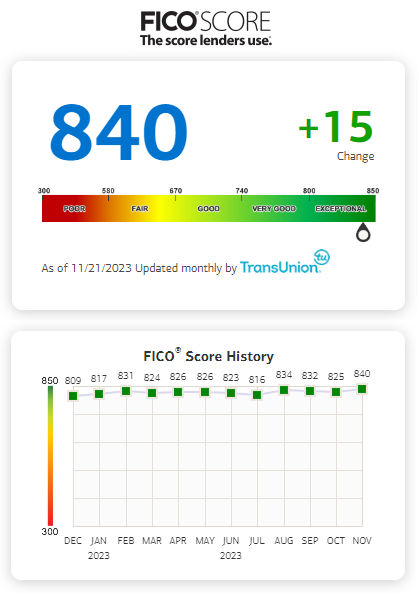

What Leveling Up Looks Like

A stronger credit score opens doors — to better rates, bigger opportunities, and the lifestyle you’ve always wanted.

A beautiful home

A reliable or luxury car

Family stability

Financial peace

More freedom and options

For New Credit Holders

Start fresh

Build new lines

Learn smart credit habits

Grow your score early

Set your future up for success

Bankruptcy - We help clients address bankruptcies and work to remove or improve their impact on credit reports.

Repossessions - Assistance with resolving repossessed accounts and improving credit standing.

Late Payments - We work to remove or correct late payments that hurt your credit score.

Judgements - Helping clients address court judgments and reduce their negative effect on credit.

Student Loans - Assistance with reporting errors or negotiating solutions for student loan issues.

Collections - We challenge or resolve collection accounts to improve your credit report.

Identity Theft - Help disputing fraudulent accounts or charges caused by identity theft.

Tax Lines - Assistance with correcting or removing tax lien information from credit reports.

Charge Backs - We address incorrect chargebacks that appear as negative items.

Settled Accounts - Helping clarify or correct accounts marked “settled” instead of “paid in full.”

Foreclosures - Assistance in disputing or managing foreclosure records on your credit report.